missouri employer payroll tax calculator

Employers can use the calculator rather than manually looking up. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

![]()

What Is Line 10100 Or 101 On Your Tax Return Loans Canada

Get Started With ADP Payroll.

. Ad Process Payroll Faster Easier With ADP Payroll. The maximum an employee will pay in 2022 is 911400. Missouri Hourly Paycheck Calculator.

All Services Backed by Tax Guarantee. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Missouri is currently not a credit reduction state.

It is not a substitute for the advice of. Discover ADP Payroll Benefits Insurance Time Talent HR More. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Work out your adjusted gross.

Missouri Payroll for Employers. Employees with multiple employers may refer to. All corporations and manufacturers doing business in the state.

Important note on the salary paycheck calculator. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Taxes to withhold Your Missouri State Taxes to withhold are Need to adjust your withholding amount.

So the tax year 2021 will start from July 01 2020 to June 30 2021. All Services Backed by Tax Guarantee. Both the employer and the employee pay the same amount in Social.

Complete an updated MO W-4 and submit to your employer. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. Ad Payroll So Easy You Can Set It Up Run It Yourself. Medicare 145 of annual salary.

Social Security of 62 of annual salary7. Employers withholding 100 per quarter to 499 per month must file and pay on a quarterly. Ad Process Payroll Faster Easier With ADP Payroll.

Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only. This is a rate calculation based on the ratio between an employers average annual taxable payroll unemployment benefit charges against its account and taxes paid previously by the.

Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20. Employers covered by Missouris wage payment law must pay wages at least semi-monthly. Ad Payroll So Easy You Can Set It Up Run It Yourself.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The standard FUTA tax rate is 6 so your max. That tax rate hasnt changed since 1993.

The Missouri Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Missouri State. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Missouri Salary Paycheck Calculator.

Yes you read that right. Employers withholding 500 to 9000 per month must file and pay on a monthly basis.

State Payroll Taxes Guide For 2020 Article

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

How To Do Payroll In Excel In 7 Steps Free Template

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Parents Who Have A Child With Cerebral Palsy Should Know Before Filing Taxes Tax Preparation Business Tax Business Advisor

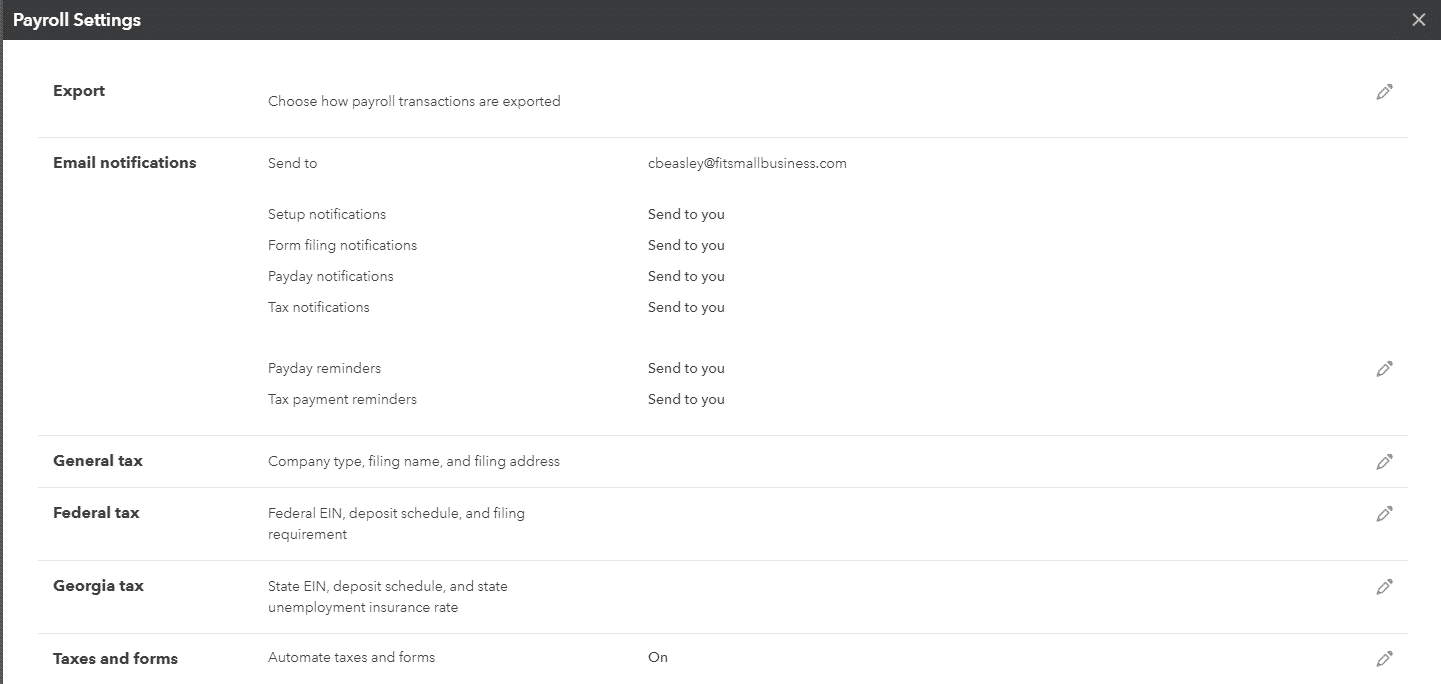

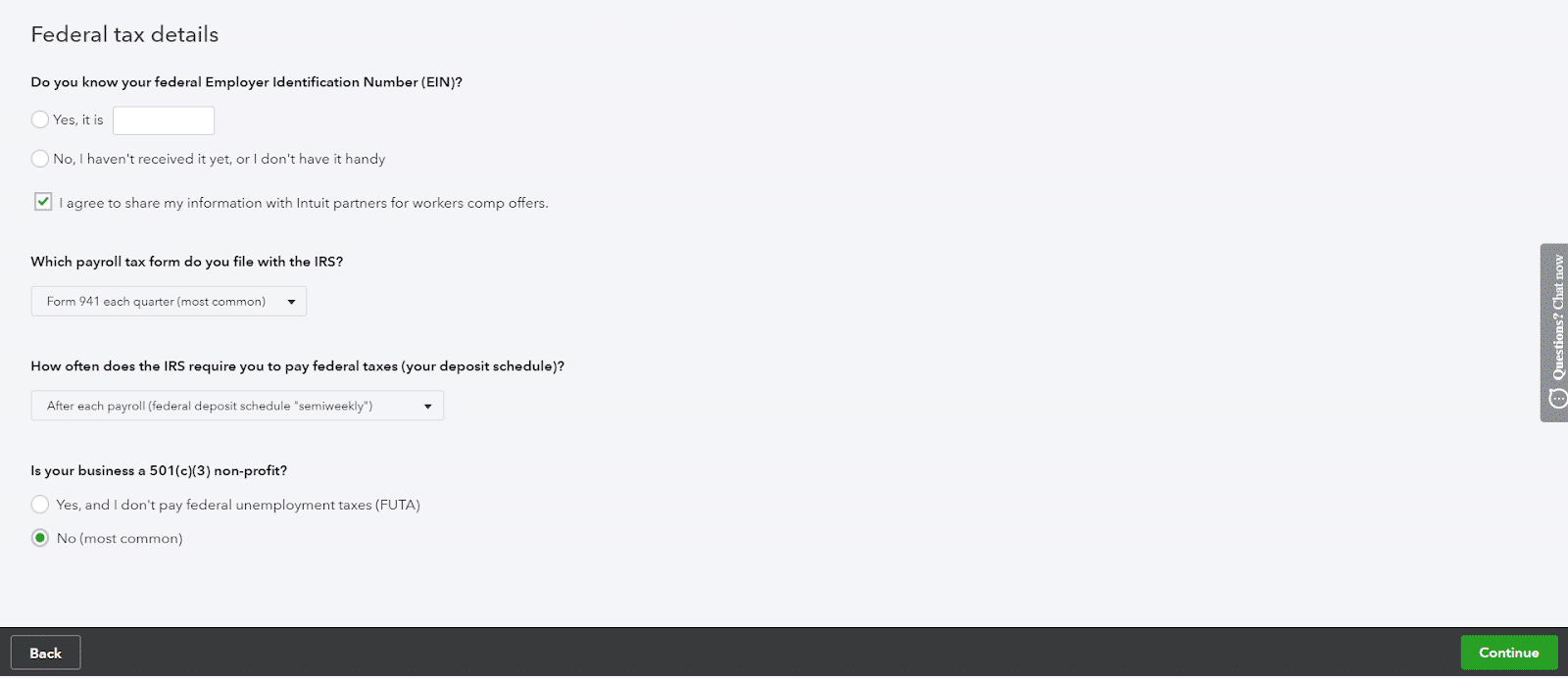

How To Set Up Pay Payroll Tax Payments In Quickbooks

Goodwill Donation Values Spreadsheet Personal Financial Statement Financial Statement Statement Template

I Just Realized That Someone Making 150k In Bc Pays The Same Percentage Of Income Tax As Someone Making 65k In Qc Before Any Deductions R Personalfinancecanada

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

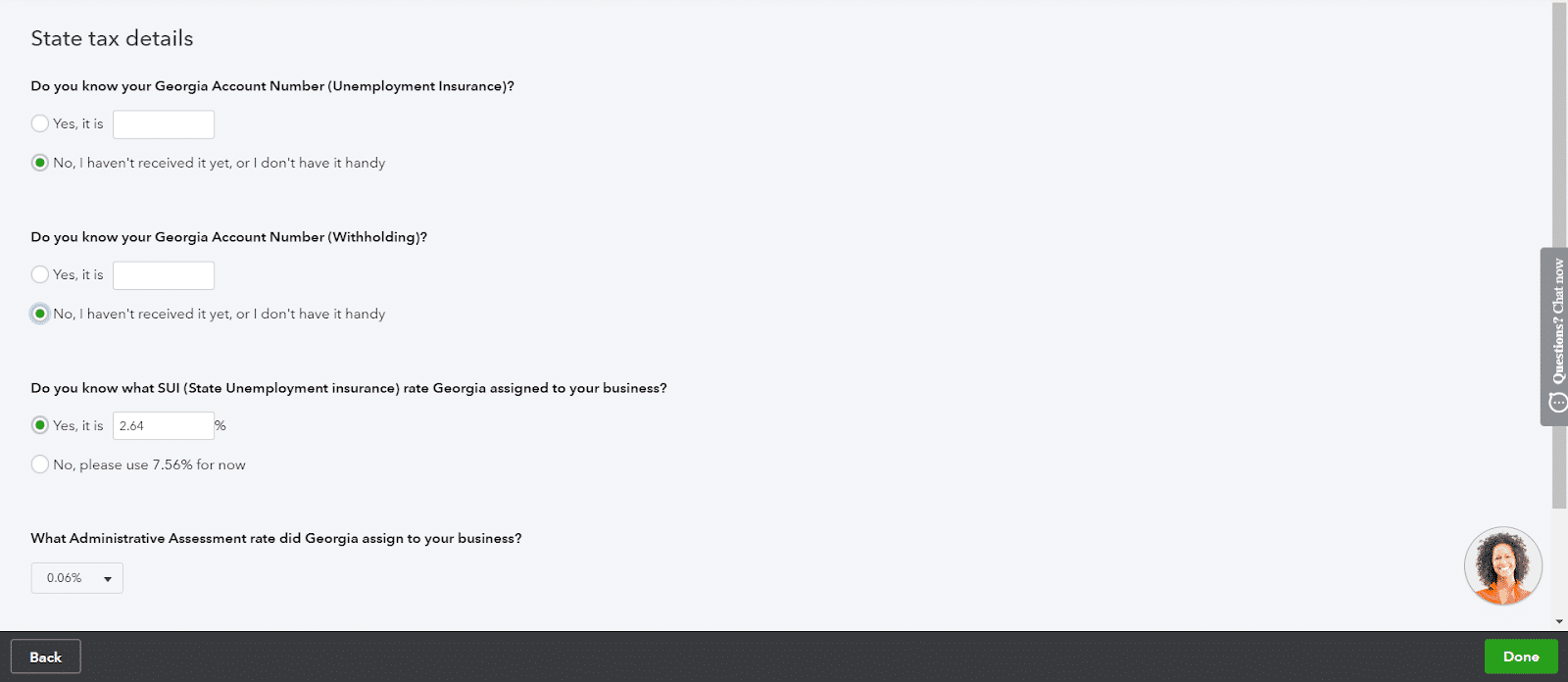

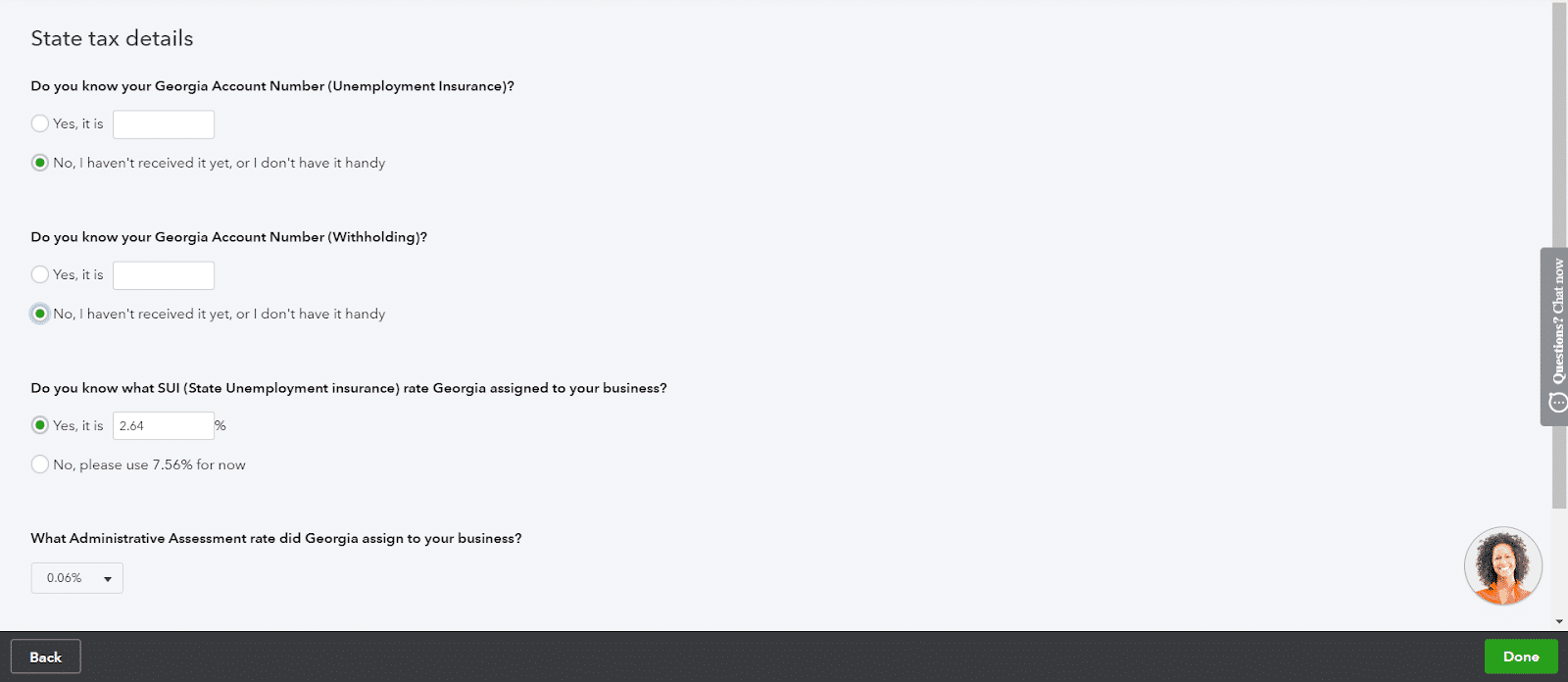

How To Set Up Pay Payroll Tax Payments In Quickbooks

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

How To Set Up Pay Payroll Tax Payments In Quickbooks

Teks Lesson Plan Template Best Of 62 Free Pay Stub Templates Downloads Word Excel Pdf Doc Lesson Plan Templates Teks Lesson Plans Downloadable Resume Template

2022 Federal Payroll Tax Rates Abacus Payroll